Event Details

CAS Office

Arlington, VA

About This Event

Registration for this event will be paused starting on December 31, 2024 while the CAS migrates to a new Association Management System. Submit your email using the form, https://www.casact.org/form/registration-notification-reserv, to be alerted as soon as event registration reopens.

Understanding reserve variability has become an important skill for practicing actuary. Moving from point estimates and deterministic ranges to distributions of possible outcomes is one of the critical quantitative building blocks for effective Enterprise Risk Management. Insurance executives, regulators, risk managers and rating agencies are all beginning to raise the bar for the actuarial profession with respect to discussing and disclosing insurance risk calculations. The first day of the event, a statistical review will be held.

Attendance is limited to a maximum of 35 participants. Attendees will be selected on a first registered, first accepted basis. Participants are expected to bring their own laptop to the seminar.

PURPOSE

This seminar is designed to enhance the skills of the practicing actuary with regard to fitting and using and communicating results from loss reserve models. The emphasis in the seminar will be on the process of moving from deterministic methods for estimating a single point to stochastic models for estimating a distribution.

The learning objectives include:

- Review of Statistical Concepts

- Understanding of Ranges vs. Distributions

- Knowledge of Statistical Modeling Techniques

- Hands on Use of Models, with Emphasis on Simulation Models

- Understanding of Diagnostic Testing

- Understanding of Model Strengths & Weaknesses

- A Better Understanding of Quantifying and Communicating Uncertainty

TARGET AUDIENCE

The target audience for this seminar are actuaries that are new to statistical/probabilistic reserving or that want a ground up refresher course. While some review of the theoretical underpinnings will be included, the emphasis will be on practical aspects of using stochastic models.

PREPARATION

A review of basic statistical concepts and an exercise set will be sent out prior to the start of the seminar. Attendees are expected to understand these concepts. A review of these statistical concepts will be held at the beginning of the seminar.

Attendees are encouraged to read sections 1 through 3.1 (pages 1-24) of the Working Party on Quantifying Variability in Reserve Estimates final report prior to the seminar. However, no prior knowledge of the concepts and models in this report will be assumed. The seminar will be organized around the practical issues discussed in the Working Party report, including a hands-on look at several stochastic models. Fluency in Excel is recommended.

Attendees are encouraged to bring the following:

- A laptop computer that has Microsoft Excel loaded (2003 or later version recommended - earlier versions should still work, but the instructors cannot guarantee this ahead of time).

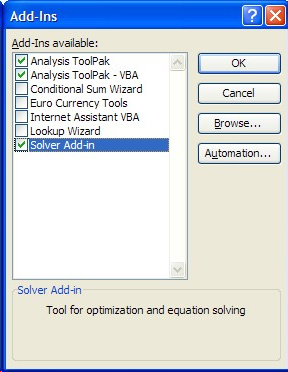

- The instructors will be using and distributing Excel files and using add-in tools to do numerical calculations. Be sure that the Analysis ToolPak, Analysis ToolPak - VBA and Solver Add-Ins for Excel are installed on your machine. Files will be distributed via email before the seminar.

Casualty Actuarial Society's Envisioned Future

The CAS will be recognized globally as the premier organization in advancing the practice and application of casualty actuarial science and educating professionals in general insurance, including property-casualty and similar risk exposure.

Continuing Education Credits

The CAS Continuing Education Policy applies to all ACAS and FCAS members who provide actuarial services. Actuarial services are defined in the CAS Code of Professional Conduct as "professional services provided to a Principal by an individual acting in the capacity of an actuary. Such services include the rendering of advice, recommendations, findings or opinions based upon actuarial considerations". Members who are or could be subject to the continuing education requirements of a national actuarial organization can meet the requirements of the CAS Continuing Education Policy by satisfying the continuing education requirements established by a national actuarial organization recognized by the Policy.

This activity may qualify for up to 24 CE credits for CAS members. Participants should claim credit commensurate with the extent of their participation in the activity. CAS members earn 1 CE credit per 50 minutes of educational session time, not to include breaks or lunch.

Note: The amount of CE credit that can be earned for participating in this activity must be assessed by the individual attendee. It also may be different for individuals who are subject to the requirements of organizations other than the American Academy of Actuaries.

Accessibility

The CAS seeks to do its utmost to provide equal access to participants with disabilities in accordance with State and Federal Law. Please refer to our Accessibility page for more information.

Speaker Opinions

The opinions expressed by speakers at this event are their own and do not necessarily reflect the opinions of the CAS.

Contact Information

For more information on content, please contact Wendy Ponce, Professional Education Coordinator, at wponce@casact.org.

For more information on workshop logistics or attendee registration, please contact Leanne Wieczorek, Meeting Services Manager at lwieczorek@casact.org.

For more information on other CAS opportunities or regarding administrative policies such as complaints and refunds, please contact the CAS Office at (703) 276-3100 or office@casact.org.

Limit up to 35 participants

When registering for this event online, please select your reg type to see the event fees available.

Limited to individual registrations only. Group registrations are not permitted.

| EARLY (ON/BEFORE MARCH 21, 2025) | LATE (AFTER MARCH 21, 2025) | |

|---|---|---|

| Member | $1,550 | $1,750 |

| Non-Member | $1,750 | $1,950 |

Cancellation Information

Registration fees will be refunded for cancellations received in writing at the CAS Office via email, refund@casact.org, by March 21, 2025 less a $200 processing fee.

Louise Francis, FCAS, CSPA, MAAA is the Consulting Principal and founder of Francis Analytics and Actuarial Data Mining.

Ms. Francis has introduced insurance professionals to advanced modeling methods, including predictive modeling and reserve variability modeling, both as a speaker at conferences and as an author of papers and articles.

Ms. Francis is a former VP Research for the CAS. Ms. Francis was a winner of the CAS’ Matthew Rodermund award for her lifetime contributions as a volunteer.

Louise won the Michelbacher award (1989) for a paper about using simulation to quantify loss variability. She regularly applies simulation to loss reserve variability analysis and reinsurance program evaluations.

Mark R. Shapland, FCAS, FSA, MAAA, an Associate Actuary with the Auto Club Group, was the chair of section three for the Reserve Variability report, has written a paper on a statistical approach for determining reasonable reserves, and has spoken on the topic of reserve variability at many CAS and international meetings.

All times are listed in Eastern time.

| Date | Time (EST) | Activity |

|---|---|---|

| Monday, April 7 | 8:30 am – 11:30 am 11:30 am – 1:00 pm 1:00 pm – 3:30 pm 3:30 pm – 3:45 pm 3:45 pm – 5:00 pm |

Statistics review; breakfast on your own Lunch on your own Seminar Break Seminar |

| Tuesday, April 8 | 8:00 am – 10:30 am 10:30 am – 10:45 am 10:45 am – 12:30 pm 12:30 pm – 1:30 pm 1:30 pm – 3:30 pm 3:30 pm - 3:45 pm 3:45 pm – 5:00 pm |

Seminar (breakfast provided) Break Seminar Lunch (provided) Seminar Break Seminar |

| Wednesday, April 9 | 8:00 am – 10:30 am 10:30 am – 10:45 am 10:45 am – 12:30 pm 12:30 pm – 1:30 pm 1:30 pm – 3:00 pm |

Seminar (breakfast provided) Break Seminar Lunch (provided) Seminar |