Research Announcements

Membership / Notices to Members, Publications & Research, Research

Membership / Notices to Members, Publications & Research, Research

Climate, Membership / Notices to Members, Publications & Research, Research

Most Recent Publications

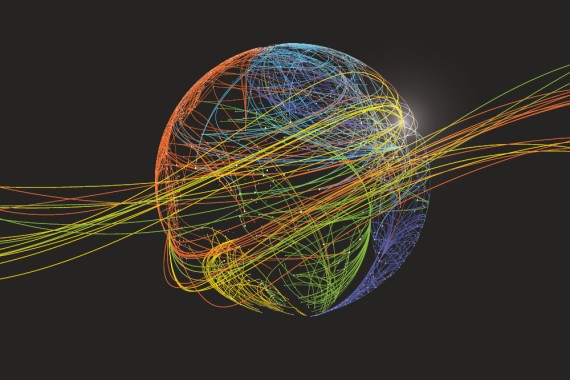

Artificial Intelligence

2024

Working Parties and Task Forces

Working parties and task forces are important to the future of CAS. Run by volunteers, they help further the development and dissemination of information in their area of expertise; monitor similar organizations, professional developments and regulatory activities; and sponsor panels, seminars or other professional education opportunities.

Opportunities & Open Calls

Individual Grants Competition

The Casualty Actuarial Society (CAS) is pleased to announce its individual grant research recipients for 2025.

The Casualty Actuarial Society (CAS) and the Society of Actuaries (SOA) Research Institute's Committee on Knowledge Extension Research (CKER) announce the 2025 Individual Grant Competition.

The Casualty Actuarial Society (CAS) is pleased to announce its individual grant research recipients for 2024. They…

Climate Change Resources

This repository of recent climate change-related research and professional education features papers, presentations, and recordings from CAS publications and meetings, as well as interviews and press related to the topic.

Actuaries Climate Index

The Actuaries Climate Index® (ACI) is an educational tool designed to help inform actuaries, public policymakers, and the general public about climate trends and some of the potential impacts of a changing climate on the United States and Canada.

Research Awards

Research Awards encompass a variety of casualty-property topics and are meant to highlight the best papers and other research produced by both CAS members, and actuarial journals.

Research Resources

Peruse useful databases, research topics by subject, and recommended readings.

Suggest a Research Idea

The CAS research committees are interested in your input to potential funded research projects.

Past Research Projects

This page includes past calls for papers, funded research projects, and working party/task force reports.

Research Grants

The CAS offers research grants to further the body of knowledge in actuarial science and encourage researchers to submit proposals that address emerging and classic industry challenges through various methodologies.

To apply for a grant, please fill out a Research Grant Proposal Form.